Income Tax Filing Limit 2025. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. It is important to remember income tax related deadlines in a year to avoid paying penalties, penal interest, to file income tax return (itr) in time etc.

Income tax slab rate for old tax regime. For old regime, a tax rebate up to rs.12,500 is applicable if the total income does not exceed rs 5,00,000 (not applicable for nris) note:

On or after january 1, 2025 must file its initial beneficial ownership report within either 90 days (for reporting companies created or registered in 2025) or 30 days (for reporting companies.

Individual Tax Return Online Filing Tax Online Through Easy, The content on this page is only to give an overview and general guidance and is not exhaustive. Updated as per latest budget on 1 february, 2025.

Taxes Know A Vet, Section 194p of the income tax act, 1961 provides conditions for exempting senior citizens from filing income tax returns aged 75 years and above. Income tax return (itr) and tax planning.

Tax And TDS Return Filing Service in Connaught Place, Delhi, Income tax return (itr) and tax planning. Under the old regime, individuals below 60 years of age have to file an itr if their income exceeds rs.2.5 lakhs and individuals above 60 years of age have to file an itr if their income is more than rs.3 lakhs.

Pennie Limits 2025 Calculator Raye Valene, The content on this page is only to give an overview and general guidance and is not exhaustive. Tax rebate up to rs.12,500 is applicable for resident individuals if the total income does not exceed rs 5,00,000 (not applicable for nris.

Tax Return Filing Service at best price in Mumbai ID 23872724248, Income tax slab rate for old tax regime. Tax year 2025 filing thresholds by filing status.

Tax Calculator Canada 2025 Image to u, It is a distinct legal entity separate from its partner. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Four days to ITR 202122 filing deadline Don't to everify your, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Jun 16, 2025, 12:54:00 pm ist.

Why Everyone Should Be Paying Attention To The Benefits Of Filing ITR, Section 2 (1) (n) of the limited liability partnership act, 2008 defines “limited liability partnership” as a partnership formed and registered under the act. The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from $7,430 for tax year 2025.

Tax Consultant at Rs 1000/session in Thrissur ID 27356721597, These are the official numbers for the. It's used for tds deduction and should be linked to your bank account for direct income tax refunds.

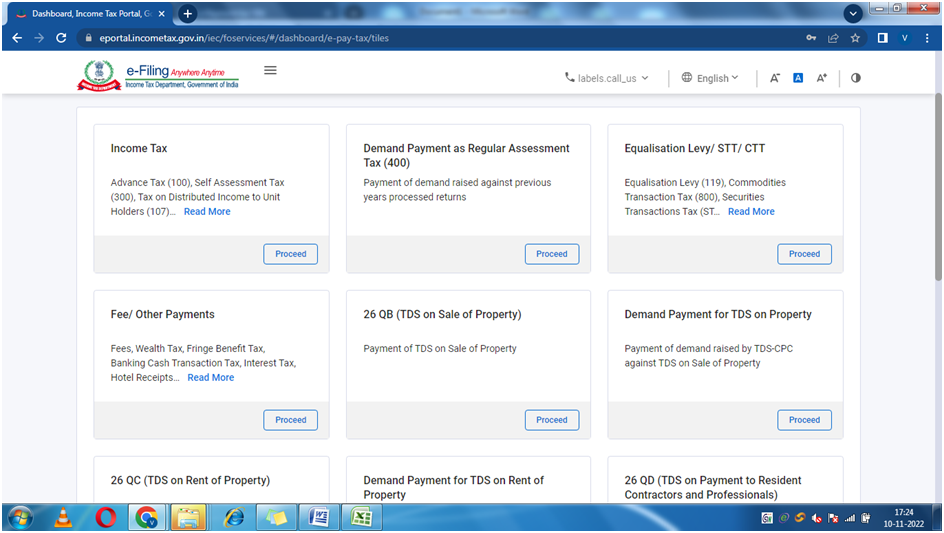

Steps to epay Tax, TDS through Tax Portal, Having income under the head profits and gains of business or profession. Senior citizen should be of age 75 years or above;

In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).